11 mins read

Understanding the Difference Between Profit Margin vs Markup in Construction

One of the first and most important steps to ensure a healthy profit in construction is knowing the difference between profit margin and markup. With margins averaging just 5%, understanding profit margin vs markup is essential. Many business owners are not producing as much profit as they think, based on common misunderstandings and misconceptions that can negatively impact cost estimation in construction projects.

To ensure that your business is charging the correct price for your products and services and you are not missing out on potential profits, all construction professionals should fully understand these terms and the relationships between them.

In this blog post, we take a closer look at margin vs markup and explain the important similarities and differences between the two concepts. We also provide useful definitions, formulas, and examples to minimize confusion.

Let’s dive in!

What Is Profit Margin?

The profit margin (or gross margin) is a measure of how much money a construction company will retain after the cost of goods (COGS) is subtracted from the revenue (sales). Profit margin is typically stated as a percentage.

The margin formula subtracts the COGS from the revenue and then divides what is left over by the revenue to understand better how much of the sales amount will profit and how much is consumed by costs.

Margin = [(Revenue – COGS) / Revenue] X 100

For example, if a roofer charged a customer $5000 and their total COGS was $4000, the gross margin would be 20%.

Margin = [(5000 – 4000) / 5000] X 100 = 20%

The word “gross” is important since it tells us that this calculation is done at a high level before things like taxes and non-operational expenses are factored in. The gross margin is useful for comparing revenue to COGS, which makes it an ideal metric to understand better how costs impact overall profitability. Construction margin industry-wide averaged just over 25% in 2024, with fluctuating material costs causing a slight dip compared to previous years.

What Is Markup?

The markup measures how much a company charges for an item compared to how much they pay for it. For example, if you purchased a car for $10,000 and then sold it for $11,000, you would be adding a $1000 (or 10%) markup to ensure the transaction was worth the time and effort.

The same principle applies to construction markup, although it typically involves more complex situations, with products and projects having many different contributing costs and expenses to consider.

The markup formula is very similar to the margin formula, except the COGS is now the basis of comparison or the new denominator in the equation:

Markup = [(Revenue – COGS) / COGS] X 100

Using our car resale example, the margin would be calculated as:

Markup = [(11,000 – 10,000) / 10,000] X 100 = 10%

Understanding how to calculate markup percentages is very important in the construction industry since contractors and vendors can set their pricing appropriately. Unnecessarily high markups may lead to rejected bids or a lack of repeat business. In contrast, low markups can provide insufficient funding to cover all expected and unexpected costs while still turning a reasonable profit.

Important Terminology to Understand Markup vs Margin

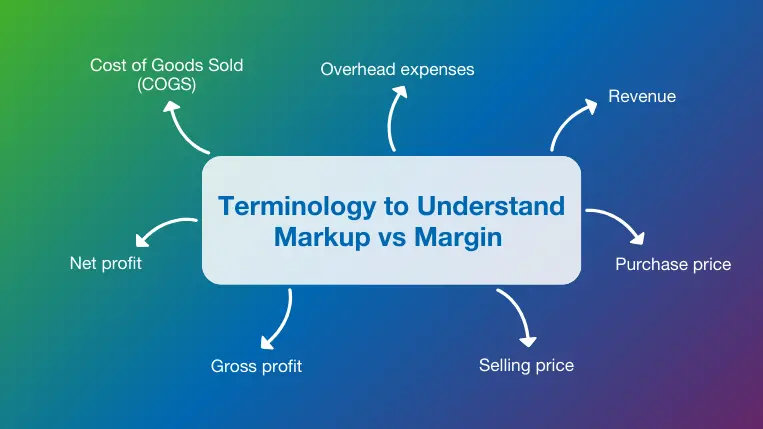

To fully understand the difference between profit margin vs markup, you need to have a solid grasp of the various terms associated with the subject.

The following are some important terms and definitions that help to differentiate these concepts when exploring the profitability of a construction business.

- Cost of Goods Sold (COGS). Also known as the direct cost, the cost of goods sold includes every expense needed to complete the project. These job costs include materials, labor, equipment, capital, fuel, and any other costs directly related to the project. Essentially, every expense that goes into the different types of construction projects falls under the cost of goods sold.

- Overhead Expenses. These costs are those that the company will face regardless of the project at hand. They are necessary to keep the business running but are not directly tied to a specific project. Overheads include office rental, support staff salaries, insurance, accounting fees, debt payments, and office equipment costs.

- Revenue. All of the income or funds that enter a business are classified as revenue. This is the total amount of money that comes in before expenses, typically through the sale of goods and services.

- Purchase Price. This amount includes the base cost to procure a product or service and any additional taxes, fees, and shipping expenses. All elements of the purchase price are rolled into the COGS. For example, a lumber order costing $100, plus $10 each for delivery and sales tax, would have a purchase price of $120.

- Selling Price. The final amount at which a product, service, or material is offered to a customer. This price reflects what the buyer is willing to pay to acquire the material or service and includes the costs incurred by the seller plus the markup they add to ensure a profit is made.

- Gross Profit. Once you take the revenue and deduct the COGS, your gross profit will be determined. This is the dollar amount that remains before the operating expenses, taxes, and other non-operational costs are accounted for. Gross profit indicates a business’s efficiency in producing and selling its products.

- Net Profit. This is the total amount left over after you deduct all expenses from the gross profit, including the indirect costs. Net Profit is the revenue minus COGS and overhead, also known as the “bottom line.”

When evaluating a business’s profitability, you must determine exactly how revenue is converted into net profit. Understanding this is the first essential step in understanding profit margin vs markup and how to use them in different construction cost estimation methods.

Profit Margin vs Markup: Why the Confusion?

The difference between profit margin and markup is not always apparent, but these are not two metrics you can use interchangeably.

To sum up, markup refers to the difference between the cost of goods and services and the price you charge (selling price). It is added to the price to ensure the profit and overhead expenses of the company are accounted for.

On the other hand, the margin (or gross margin) is a percentage of the revenue that depicts the gross profit on the job. After you deduct the cost of goods from the revenue, the margin is calculated as a percentage of the revenue rather than the COGS.

Basically, a markup is added to the costs of the job, while the margin represents the gross profit from sales. So, the markup percentage you apply to a job will not equate to the same margin.

The subtle differences in calculating markup vs margin make it easy to understand how these terms and concepts are easily confused. Since the formulas look similar, those lacking a full understanding of the concepts might discuss margin versus markup as if they were identical, further adding to the confusion. This can be a costly error since a 10, 25, or 50 percent markup will not provide an equivalent profit margin.

Knowing how the two metrics are related helps to further clarify the differences, and this relationship can be explained easily using additional formulas:

Margin = [Markup / (1 + Markup)] X 100

Markup = [Margin / (1 – Margin)] X 100

A higher markup will also produce a higher profit margin, and you can use these handy formulas to come up with a reasonable markup based on the gross profit you are hoping to earn. Going back to our earlier car sale example, let’s say you were hoping for an 8.5% profit margin on your sale; would your 10% markup get you there?

Your Margin = [10% / (1 + 10%)] X 100 = [0.10 / (1.10)] X 100 = 9%

In this case, your gross margin would be 9%, which exceeds your goal! While the margin is always less than the markup, the exact difference varies depending on the circumstances. However, a 50% margin will always correspond to a 100% markup.

Examples of margin vs markup in construction

Some basic construction industry examples help to illustrate the difference between markup and margin and explain why both are important values to consider during bidding, estimating, and financial planning processes.

Addressing variable labor costs

The construction industry is subject to variable demand for labor based on factors including the season, the number of projects available for skilled workers, and inflation. If a contractor wants to ensure their margins remain over 20%, they must closely monitor their labor expenses and adjust their markups accordingly. The adjustable markup method allows you to monitor costs and pricing separately and then adjust markups to compensate for labor cost increases while holding gross profit margins steady.

Applying a markup to a bid

Construction contractors such as residential builders might want to set a standard markup percentage first and then evaluate their profit margin afterward. If a builder estimated their material, labor, and subcontractor fees would add up to $300,000 and applied a 20% markup to cover overhead and secure a profit, their bid to the client would amount to $360,000. This would produce a gross margin of 16.7%. Having completed these calculations, the contractor would need to decide if this margin was adequate since variable costs were not accounted for in the bid.

Same bid, different markup

Two contractors might tender equivalent bids with completely different costs and markups, leading to the same result. If the first contractor estimated their COGS to be $1 million and added a 50% markup to the bid, and the other held their fixed costs to $750,000 and applied a 100% markup, both would end up bidding an identical amount: $1.5 million.

However, because of the vastly different COGS, the first contractor would only make a 33% profit margin, while the second contractor would make 50%. This discrepancy would be an important data point for the client since it might indicate that lower quality materials and equipment were considered or there was a misunderstanding regarding material quantities or project scope.

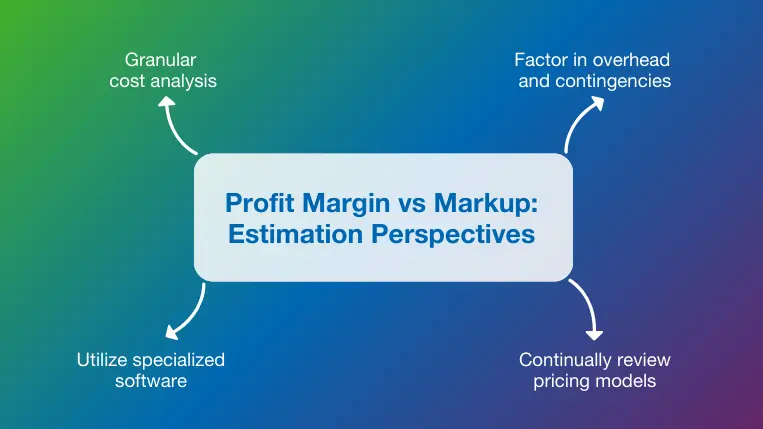

Profit Margin vs Markup: Estimation Perspectives

When determining fair and accurate construction estimates, the business owner and construction estimator may take a different approach or have slightly different perspectives.

The estimator will generally focus their attention on the markup since their job is to calculate costs and add an additional amount they believe is reasonable. Owners tend to focus more on the margin and review the future vs past performance of the business to measure profitability and success compared to established targets.

It is essential to take both perspectives into account when calculating estimates for a project. This, along with advanced cost estimating software, will result in an accurate bid that will likely garner positive client attention while still providing an attractive profit.

Some additional practices that can help you apply your understanding of margin vs markup to support the estimating process and get better results include:

1. Granular cost analysis

The best way to improve transparency between estimators and owners while making the importance of construction markup clear is by breaking down costs and expenses to a granular level that includes detailed quantity, duration, and selling price determinations. In this way, the markup for each project element or task and its resulting impact on the margin can be carefully evaluated and reviewed by all important stakeholders.

2. Factor in overhead and contingencies

Unexpected and unplanned costs have the potential to derail project schedules and sink profit margins, so accurate overhead and construction contingencies should be a priority throughout the project lifecycle. This importance is highlighted by the difference between gross and net profit margins since gross profit margins do not consider many cost categories, such as administrative, legal, and utility expenses, that are likely to increase when projects are delayed. Risk assessments and historical data review early on help to ensure contingencies are as accurate as possible.

3. Continually review pricing models

Any changes in material, labor, or equipment costs can significantly impact the markup and margin since profits are diminished if the selling price is not adjusted to reflect the increase in the purchase price. Takeoff and estimation software solutions linked to material and labor cost databases are useful for keeping pricing models in line with expected profit margins. These tools can also be linked to relevant contractor quotes to secure the best price when estimating.

4. Utilize specialized software

Once you understand how to calculate markup and margin, it is time to turn the process over to software tools that can automatically calculate the impact any material, labor, equipment, or overhead cost changes have on the profit margin and allow you to adjust your pricing models in real-time while maintaining an acceptable profit margin.

While many of these basic calculations can be completed using homemade spreadsheets, integrated construction estimating software like RIB Candy allows you to pull data from real-time cost databases and utilize convenient workflows to automate bid tendering, estimating, cost accounting, and reporting processes.

Final Thoughts

Understanding profit margin vs markup in construction is essential to success. However, this terminology is something that is often miscommunicated or misunderstood during the construction process, potentially leading to inadequate margins or overly constrictive labor and material budgets. A lack of understanding can easily result in contractors charging too little for their work and not seeing the net profit they could or should be making. Therefore, it is crucial for construction businesses to know how to calculate these values correctly and set their pricing accordingly.

Complementing your efforts and expertise with the power of innovative software can provide a huge competitive advantage. RIB Candy, our platform for estimating and planning, offers powerful features that take your cost estimation process to the next level with increased speed, accuracy, and transparency. If you are ready to benefit from state-of-the-art construction technology, get a free demo of RIB Candy today!

Most Recent

11 mins read

11 mins read

10 mins read

10 mins read

Blog Categories

Ebook