11 mins read

Understanding Bid Security in Construction

When an invitation to bid (ITB) is issued to a general contractor or subcontractor, it sets in motion a kind of courtship where contractors vie for the attention and trust of the project owner or procuring entity – for the purposes of this article, the project client. It’s not enough to select the best firm for the project; to ensure their project maintains momentum, the bid proposal they consider must also be sincere.

The Miller Act of 1935 in the United States was aimed at ensuring tender security in federal construction projects. The Act developed regulations to promote accountability and fair competition in the bidding process, protecting the interests of taxpayers – this was the origin of the concept of bid security for the construction industry. Tender security calls for the bidding contractor to put their money where their mouth is.

This blog post explores the concept of bid security and its role in facilitating an effective and secure bidding process.

What is Bid Security in Tender Processes?

Bid security is a financial safeguarding mechanism that protects the construction project client from failure on the part of the winning bidder to follow through on their bid.

For the bidder, it’s a way of demonstrating the legitimacy of their bid, their credibility, and readiness to fulfill their contractual obligations. For the client, it’s a way of sifting out frivolous bids to leave only the serious contenders in the race. For this reason, bidding contractors offer bid security in response to an invitation to bid. If the winning bidder defaults in any way, they forfeit the funds set aside, which are then paid out to the client.

When a winning bidder defaults, it delays the project. It costs the client more time and money to re-tender and choose an alternate bid winner. Bid security compensates for this at a value calculated as a percentage of the budget estimate of a procurement requirement. The actual percentage amount varies depending on the size of the project, commonly starting with 5-10% of the total estimated project cost, potentially up to 20% of the bid price on large federal and public projects.

The bid security amount can be calculated at a percentage of the bidder’s offer or at a percentage of the allocated budget for the procurement requirement. If the procurement method does not permit revealing the allocated budget, a fixed amount is set or a percentage of the bid.

The bid security is submitted along with the tender proposal during the bidding process in the form of a bond, unconditional bank guarantee, check, or letter of credit within the timeframe stipulated by the procuring entity. This guarantees that if the client should award the contract to a particular contractor, the contractor will not withdraw their bid within the period designated for bid acceptance. Furthermore, that contractor will provide the necessary performance and payment bonds as the final assurance that they will execute the contract.

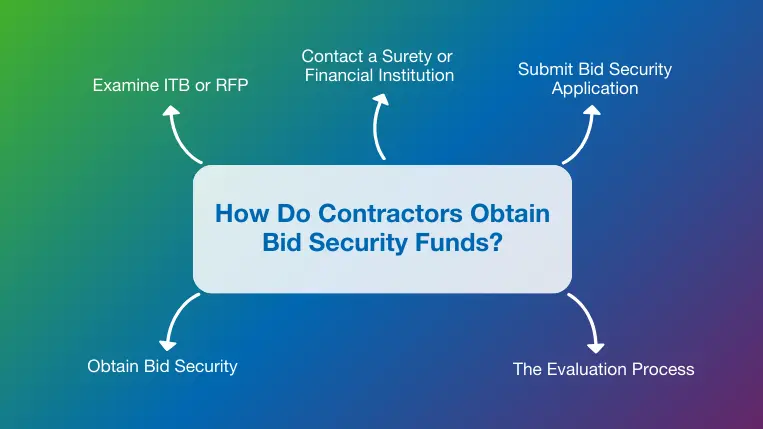

How Do Contractors Obtain Bid Security Funds?

During this important phase of construction procurement management, the question burning in the client’s mind is: Is this contractor a reliable choice? By providing bid security the contractor can demonstrate their professionalism and that they are a serious contender. So, how do contractors go about obtaining the bid security funds that will enable them to compete?

1. Examine ITB or RFP

The process begins upon receipt of the Invitation to Bid or Request for Proposal from the client. The contractor reviews the documentation, which will list the kind of bid security required, and the amount. Once these criteria are understood, the contractor can prepare the next actions to take to fully satisfy the bid security requirements.

2. Contact a Surety or Financial Institution

Depending on the bid security type, the contractor approaches a financial backer in the form of a surety broker or bank. Surety companies help with bid bonds while banks can help with letters of credit, cash guarantees, or checks.

3. Submit Bid Security Application

The onus is on the contractor to evince professional and financial stability to get good terms from the surety or financial institution. They submit their bid security application along with specifics of the project, the bid amount and validity period, and any other information required by the surety or bank. Other pertinent details include information about past and current projects, finances, business practices, and creditworthiness.

4. The Evaluation Process

The bank or surety reviews the contractor’s application, a process that depends heavily on the accuracy and thoroughness of the submission. Based on the information provided, the project risk is evaluated against the contractor’s financial stability, and if the bid security is approved, it is issued in the format stipulated in the bidding requirement documentation.

5. Obtain Bid Security

The surety broker provides a bid bond to guarantee that the contractor will adhere to the conditions set out in the client’s bid invitation. For other types of bid security like checks or letters of credit, the bank compiles the paperwork necessary to guarantee the correct allocation of funds. With the bid security in hand, the contractor then submits their bid to the project client along with all other required documents in adherence to the bid criteria.

It is a painstakingly detailed process and, given its importance, demands attention and preparation. For contractors in construction, the bidding process is the first crucial shot at landing a project. So, projecting an image of reliability and competence is vital – and that starts with getting bid security right. To round off our tips for obtaining bid security, we recommend the following best practices:

- Start early: Begin the process well ahead of the submission deadline to accommodate any unforeseen delays or issues.

- Maintain good relations: Establishing security is easier when there is a good rapport between the bidding contractor and their financial institution.

- Keep accurate records: Project histories and accurate financial records help to increase the likelihood of good terms from banks and sureties.

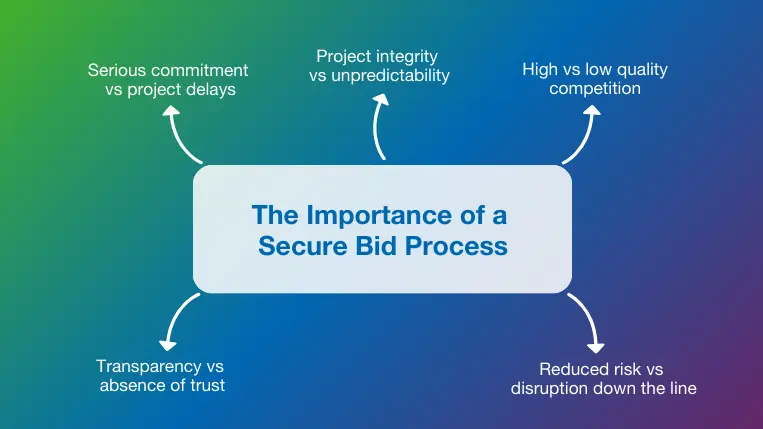

The Importance of a Secure Bid Process

A secure, robust bid process sets the tone for the smooth and successful execution of a construction project. It’s worth noting the wider ramifications of a secure bid process versus the lack thereof:

- Serious commitment vs project delays: As a mechanism that guarantees a secure process, the bid security demonstrates that a contractor is serious and financially able to complete the project they have tendered for. Tender security reduces the possibility of contractors withdrawing from a project without notice (or penalty), which would otherwise result in costly delays and re-tendering.

- Project integrity vs unpredictability: A secure process protects the client against the consequences of a winning bidder withdrawing their bid or refusing to sign the contract. Contractors show their commitment by undergoing this process and adhering to bidding requirements. It gives the client confidence that they won’t suffer any disruptions; and if a bidder defaults, the bid security helps to mitigate disruption.

- High vs low quality competition: Only the most prepared, capable, and serious contractors are likely to participate in such a rigorous vetting process, given the attention and commitment it requires. As it filters out potentially frivolous bids and bidders who are unable to commit 100%, it guarantees that the project draws only qualified, competitive bids – and so, improves the quality of bids.

- Reduced risk vs disruption down the line: A secure process lowers the probability of entering into a contract with unreliable contractors. Instead, a contractor who makes the effort to establish a credible and professional reputation is less likely to cause disruption down the line and more likely to meet deadlines.

- Transparency vs absence of trust: Enforcing a secure process with a detailed series of checks and balances instills trust among all stakeholders, including the project client, bidding contractor, and financiers. Having clear oversight of both the bid requirements and competing proposals ensures that the winning bidder has undergone a transparent vetting process.

Tempering the Downsides of Bid Security

As securing the bid process becomes an exercise in compliance to support the important choice of winning contractor bid, there are some downsides to consider.

- It could potentially deter bidders who are otherwise highly capable of executing the project. Smaller contractors in particular might be discouraged by high bid security criteria – at the time of bidding, they might not have the necessary funds in reserve to afford the expense. This reduces the number of bids for larger companies that end up monopolizing contracts, putting the fairness argument into question.

- It may inflate bid costs as many contractors choose to incorporate the cost involved in obtaining a bid security into their rates. This addition can increase project expenses, indirectly influencing the client’s overall financial planning and budget.

- It can happen that the bid proposals of highly qualified contractors might fail to satisfy the criteria of the bidding process to the extent that they become excluded from the race altogether. As a result, the client project could potentially be denied better the workmanship and creative ideas of excluded bidding contractors.

Project clients can temper these downsides by ensuring that the criteria stated in their solicitation documentation are beyond doubt and confusion, but also contextually appropriate. For example, they should consider the state of the market to create reasonable bid security specifications that would not unfairly disadvantage smaller but qualified contractors. They should also regularly review and adjust their policies to align with industry best practices and the scale of their projects.

So, while it’s true that compliant construction bidding depends on a secure process, a competitive bidding environment depends on balancing the benefits with the potential downsides. Clearly defined and communicated criteria within the context of larger market dynamics is the best-case scenario to build on.

Types of Bid Security

As project owners seek to secure the construction bidding process, they base their choice of bid security type on the nature and size of the project, the contract requirements, and the laws and regulations governing both the bidding process and their location. The most utilized types include bid bonds, checks, cash, and letters of credit.

There can be some confusion over what is bid bond versus what is bid security as some bidders mistakenly use the terms interchangeably. A bid bond is actually a subset or type of bid security, which is the overall concept.

Let’s break down the various types of bid security for clarity:

Bid Bond

The bid bond is the most common type of bid security, utilized in many construction bids to satisfy bid security requirements. It is typically issued by a bank or an insurance company that stands surety for the bidding contractor. Bid bonds provide assurance that the bidding contractor is financially stable and committed to completing the contract at the stipulated bid price – it supports the project client’s construction cost control efforts.

If the winning bidder breaches the terms of the bid, the bid bond guarantees the client is protected financially and has recourse against any losses incurred.

How Do Bid Bonds Work?

As previously detailed, the contractor works with a surety broker to calculate the bid security amount at a percentage of the bid amount or a fixed amount as per the bidding requirements set out by the client in the ITB. The surety broker assesses the contractor’s ability and readiness to fulfill a contract, looking at:

- available assets to be used as collateral to cover the required bond amount

- reputation and track record of successfully completing similar projects

- credit history, cash flow and overall financial stability to meet project demands

- qualifications and critical decision-making skills of project management teams

Once the surety broker has done their due diligence and reviewed the contractor’s compliance, they issue the bid bond, and the contractor can submit it along with the rest of the bidding documentation. If the contractor lands the project, they are obligated to follow the terms of the contract exactly, which includes offering up the performance or payment bonds required to guarantee the completion of the project. The bid bond may then be returned to the winning bidder.

If, for whatever reason, the winning contractor fails to sign and execute the contract, the contractor forfeits those funds while the client is entitled to ‘call’ the bid bond as compensation. The surety broker pays the funds to the client. The client uses the funds to cover the difference between the winning bid and the next highest bidder, or the cost to re-tender the project. The contractor then remunerates the surety broker.

Cashier’s Check or Certified Check

Checks are often the bid security type of choice for smaller, private projects. Contractors can get a cashier’s check issued by their bank or financial institution, signed by a cashier. The check is guaranteed by the institution with funds drawn from its own reserves unlike personal checks, which draw funds from an account holder’s account. Backed by the financial institution’s creditworthiness, the cashier’s check is a safer, more reliable prospect that assures the project client that compensation will be available if required.

Where the project client places fewer restrictions on the bid security types that are acceptable to them, a certified check is a feasible option. It is a personal check made out by the account holder, certified by their bank, that shows the bank has set aside an amount of money and that the account holder has sufficient funds to cover that check. This serves as a guarantee that the check will not bounce due to insufficient funds.

How Do Checks Offer Tender Security?

Both certified and cashier’s checks provide assurance that the bidding contractor has the financial capacity and intention to execute the contract. From a simplicity point of view, checks are often preferred due to:

- Immediate availability of funds – Checks guarantee that the money set aside for bid security is available as soon as it’s clear the winning bidder will not fulfill their contractual requirements. It helps the project client get on with re-tendering quickly, but it’s also a strong incentive for bidding contractors to honor their bids.

- Streamlined process – Checks are a simple bid security option, calling for a more direct engagement between the bidder and project client. It’s simpler to deal with checks than with bid bonds that require third party involvement or surety.

- Enhanced credibility – When a bidding contractor submits a certified or cashier’s check with their bid, it demonstrates their financial stability and commitment to the project. And in a competitive tendering environment, demonstrable credibility carries tremendous weight with project clients.

Checks are as valuable as cash, and so they must be handled securely to prevent theft or loss. Another best practice tip for using checks as bid security: keep meticulous records. In fact, document everything, including receipts. Once the bidding process ends, these records will help with the retrieval or voiding of checks.

Irrevocable Letter of Credit

An irrevocable letter of credit is issued on behalf of the bidding contractor by a bank guaranteeing payment under stated terms. As it typically requires a contractor to be established and have a strong relationship with their bank, it provides an added layer of security. Once issued, it cannot be changed or revoked without the agreement of all the parties involved, including the beneficiary – in this case, the construction project client.

The primary function of an irrevocable letter of credit in secure bidding is to assure the project owner that the funds are available and will be paid if the winning bidder fails to sign the contract or meet other obligations such as providing performance bonds. It serves as a high level of financial assurance that the contractor is capable of and committed to the stated construction specifications outlined in the bid.

How Does an Irrevocable Letter of Credit Work?

The process starts with the bidding contractor approaching a bank they have relationship with:

- The contractor asks the bank to write the project owner an irrevocable letter of credit.

- The bank checks the contractor’s credit before issuing the letter, but only if they are confident in the applicant’s financial standing, adding that layer of assurance to the bid security.

- The bidding contractor maintains open lines of contact with the bank and provides regular updates to ensure that the terms noted in their letter of credit accurately reflect any modifications in the project scope or bidding criteria.

- It’s good practice to ensure the terms of the letter of credit are precise and clear, as vague language can lead to disputes and delay access to the funds later.

- It is advisable for the contractor to get legal advice before negotiating the terms and conditions attached to their letter of credit, including understanding the bank fees involved in creating and keeping an irrevocable letter of credit as the required credit amount directly impacts that cost.

- The contractor submits the letter of credit with their bid, also accepted internationally – irrevocable letters of credit are recognized in the construction industry worldwide as a reliable means of financial guarantee for projects involving foreign contractors.

When a winning bidder defaults, the project client shows the letter of credit to the issuing bank to claim the assured funds – it’s a simple procedure because the bank has already allocated the amount of money requested for bid security.

Cash

It is less commonly used for bid security; however, cash is acceptable for small, private projects.

It becomes less viable for projects with a substantial procurement budget. When a client accepts large sums of cash as security, they are stuck with the responsibility of managing it securely and transparently. The other downside is that the bidding contractor might find themselves out of pocket and unable to complete other projects they have in development.

All the same, it does serve to demonstrate strong commitment on the part of the bidding contractor. The contractor makes a cash deposit of a specific amount, which the client retains as compensation for losses incurred when a winning contractor defaults on their bid obligations.

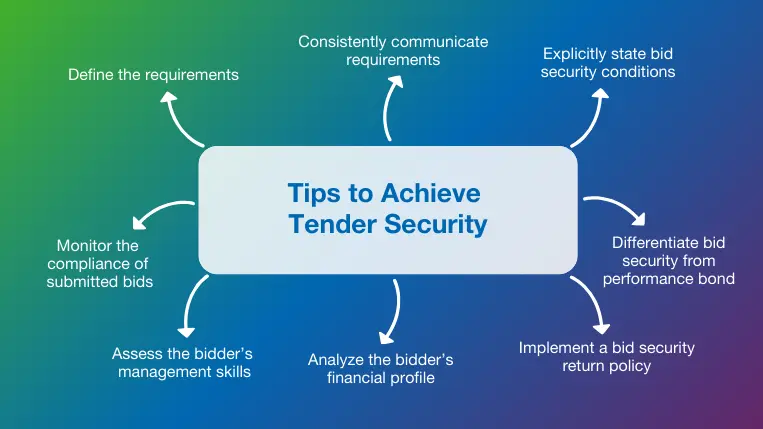

Tips to Achieve Tender Security

- Define the requirements: Clearly define the bid security requirements, including the types and percentage amounts required, along with the submission formats, additional requirements, and deadlines.

- Consistently communicate requirements: Standardize bidding documentation and construction contracts, expressing security requirements consistently to all bidders to ensure fair competition and prevent conflict or misrepresentation.

- Explicitly state bid security conditions: Add an explicit bid security clause to the bidding requirements documentation that leaves no room for misinterpretation of the action the bidder must take, and the definition and consequence of forfeiture.

- Differentiate bid security from performance bond: Avoid confusion by stipulating the bid security serves to commit the bidder to the contract and is returned to the winning bidder, while a performance bond will be required as guarantee they will complete the project to contract terms and specifications

- Implement a bid security return policy: Stipulate the conditions attached to the return of the bid security to the winning bidder after signing a contract and clearly communicate your policy with all bidding contractors.

- Analyze the bidder’s financial profile: Collect all available information about the bidder’s finances, including corporate balance sheets, income and cash flow statements, tax returns, and credit ratings to analyze their financial stability.

- Assess the bidder’s management skills: Check past project references, performance records, and resumes of key personnel to ascertain that they have the necessary qualifications and capabilities to undertake a complex project.

- Monitor the compliance of submitted bids: Vigilantly check that all submitted bids comply with the specified security requirements. To uphold the integrity of the bidding process, non-compliant bids should be disqualified.

Conclusion

The concept of bid security can be summed up as a failsafe – fundamental to a fair, competitive bidding process in the contractor procurement phase of a construction project.

The provision of bid security in the tender process guarantees that only contractors who are serious about their proposals and able to fulfill the contract if awarded, participate in the bidding process. It plays an important starting role in efficient bid management in construction projects by mitigating the risks involved in contractors defaulting on a bid or failing to fulfill contractual terms.

Both sides of the bidding process – the construction project owner or procuring entity and the bidding contractor – should ensure they understand the different types of bid security and how each works. To avoid confusion at the outset, they should be sure to differentiate between what is bid bond versus what is bid security. And all stakeholders must ensure that lines of communication in construction are kept open, procurement and bidding requirements are clear, and terms and conditions contextually relevant.

Ultimately, the benefits of tender security extend beyond securing the bid for one construction project – as it enhances the bidding process in general, it helps create a competitive and fair environment that benefits all the parties involved, supporting compliance and contract integrity across the construction industry.

Another key to your success is professional bid management software. To inject efficiency into the tendering process, our RIB Candy tool offers state-of-the-art bid management features to help you optimize proposal preparation, execution, and contract and order management. Ready to simplify your entire workflow from proposal submission to successful order execution? Get your free RIB Candy demo now!

Get My Free RIB Candy Free Trial

Most Recent

11 mins read

10 mins read

10 mins read

29 mins read

Blog Categories

Ebook