11 mins read

Construction Accounting Basics: Understanding the Diverse Accounting Practices Behind Successful Projects

No business can be successful without accurate, complete, and timely accounting processes to manage costs, meet obligations, and safeguard profitability. This is especially true in the construction industry, where the wide variety of variables encountered with each new project call for a unique set of practices. Today’s construction accounting methods have evolved to address this critical need.

In this blog post, we explain the construction cost accounting basics and how they differ from traditional accounting methods. We also provide some useful tips and best practices that help construction businesses streamline their financial tasks.

What is Construction Accounting?

Construction accounting is a specialized set of practices focused on the unique financial and operational requirements of the construction industry. These tailored accounting methods allow businesses to track expenses accurately while meeting ambitious goals and timelines.

Construction accounting methods encompass the activities required to manage cash flow and analyze profitability as projects progress toward completion. These tasks are closely intertwined with the workforce, material, and equipment costs that are monitored to ensure expectations align with reality. Contractor invoicing and payment activities are also important elements of the accounting process.

Construction accounting vs. traditional accounting

Unlike retail, manufacturing, or service-based industries that operate based on more predictable and consistent sales revenue and expenses, accounting for construction revolves around individual projects that have their own contract obligations and timelines. Each project becomes a short-term cost center to account for the variation in regulatory, workforce, and material conditions.

Accounting in construction is also impacted by the ongoing movement of workers, equipment, and materials, and the associated travel, transportation, and labor costs in each region. Mobile technology that empowers workers to track expenses in the field helps alleviate accounting challenges associated with dispersed work locations.

Construction expenses are often unpredictable, with fluctuating indirect and direct costs making it difficult to track expenses accurately, and ongoing change orders altering the financial picture along with the design. Specialized accounting methods also help to accommodate this variability.

Why is Construction Cost Accounting Important?

Construction business accounting practices help teams compare the project budget to actual expenses in real time, ensure compliance with financial regulations, and create detailed reports that provide insight into profitability and potential risk factors. Additional benefits of construction accounting include:

- Reliable cash flow and minimized payment delays

- Timely allocation of project costs and expenses

- Detailed monitoring to avoid overruns and disputes

Robust accounting practices also help to improve relationships between clients and contractors by demonstrating transparency and eliminating surprises. Overall, access to accurate financial information helps to mitigate project risks and improve decision-making.

Construction Accounting Basics

The unique challenges and requirements associated with construction accounting have given rise to practices and terminology explicitly developed for the industry.

Job costing

The general ledgers used to track financial transactions in other industries do not suffice for the complex project-based accounting in construction. Job costing methods allow expenses and task completion status to be tracked separately for each project, using construction cost codes to categorize each item within the overall job cost structure. This practice allows progress at each stage to be tracked compared to specific budget items.

Reporting

Financial reporting practices specific to the building industry include cash flow reports that give contractors visibility into how funds are being allocated, job cost reports that analyze financial performance at set intervals, and work-in-progress reports that project profitability based on costs incurred and revenue recognized.

Contract revenue recognition

Construction contracts often extend over long periods, with payments sometimes delayed based on contract terms and other factors. Contractors account for their earnings based on contract revenue recognition. This process involves defining fees and performance obligations in the contract, allocating a set price to each work item, and then recognizing revenue when each item is successfully completed. To learn more about this topic, check our blog on the different construction contract types!

Contract retainage

The concept of retainage is another important aspect of construction cost accounting that allows owners to withhold a portion of payment until they are fully satisfied with the work completed. This amount is usually 5-10% of the total contract value and is invoiced and received under a separate asset account for traceability.

Specialized construction billing

The variable, project-centric nature of the industry also leads to variability in construction billing methods. Popular options include fixed price billing for the entire job, time and material billing based on actual labor and components consumed, or unit price billing for projects like highways and airports that can be broken into multiple, distinct segments.

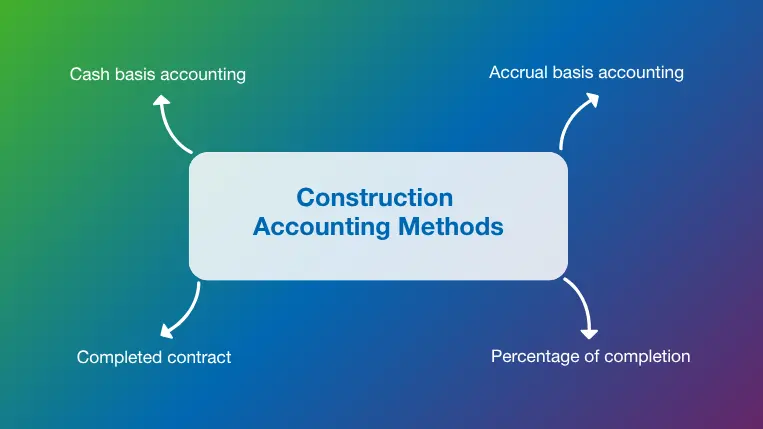

Construction Accounting Methods

Along with the specialized processes and terminology that form the basics of construction accounting, industry-specific methods have been developed to accommodate small and large businesses as they strive to balance their expenses and income while maintaining compliance.

Cash basis accounting

As the name implies, the cash basis method recognizes payments as they are received and expenses as they are paid. This method is preferred by many smaller contractors due to its simplicity but can lead to discrepancies and misleading results when expenses are paid well in advance of the invoice payment by the client.

Accrual basis accounting

Larger companies enjoy the flexibility of the accrual basis method, with revenue recorded when it is earned (rather than received) and expenses documented when they are incurred, even if they have not yet been paid. This subtle bookkeeping difference allows companies to effectively balance their cash flow on paper and comply with Generally Accepted Accounting Principles (GAAP) in the US.

Percentage of completion

This accrual accounting option provides a compromise for contractors working on long-term projects with revenue earned and invoices paid on an ongoing basis. The percentage of completion can be calculated based on the rate of overall work completed or the percentage of project costs incurred. Either method helps to even out fluctuations in costs and revenue that often occur over time.

Completed contract

Accounting for construction costs using the completed contract method (CCM) enables contractors to record all profits and expenses at the end of the project. This form of accrual accounting provides advantages by allowing revenue reporting and tax obligations to be pushed into the future and is most useful for smaller projects that can be completed relatively quickly.

Construction Accounting Tips and Best Practices

As you learn how to do construction accounting based on your own unique business model, regulatory obligations, and available software tools, a few basic tips and practices help to provide an optimized financial outcome.

1. Ensure costing is accurate

Construction accounting practices rest on a solid foundation of cost information that encompasses all materials, labor, and overhead. These individual costs must be accurate for the accounting practices to be effective, especially when the percentage of completion calculations for large projects are performed based on costs incurred. Continually adjusting cost details based on the latest material, labor, and design information helps to minimize accounting discrepancies, if allowed by the contract terms.

2. Continually reconcile accounts

Account reconciliation is the process of reviewing financial records from various sources to identify and resolve any discrepancies. In the construction industry, this includes comparing actual costs to the project allowable budget to identify any overruns or other important issues quickly. While many businesses perform their reconciliations monthly, the risk factors and complexity of construction projects make it advisable to reconcile accounts continually.

3. Perform cash flow forecasting

By gathering and analyzing all available data on project costs, revenue, and payment terms, construction companies can proactively determine when money will be received or spent in the future. Software tools help accounting teams develop a cash flow forecast for the upcoming months, so they can review expected expenditures and ensure sufficient funds will be available to keep operations on track.

4. Utilize construction accounting software

Dedicated accounting software makes it possible to automate complex processes and manage cash flow more effectively, while improving financial visibility for all key stakeholders. RIB BuildSmart is a powerful cost management software that includes helpful features to support detailed insights and seamless reporting on accrued and actual project costs at any point in time. Fully functional payroll software and inventory management data are also integrated with contract cost reporting features to improve visibility into labor and material expenditures.

Conclusion

Accounting in construction is unlike any other industry, with each unique project presenting a new set of cost variables that must be monitored and managed closely to safeguard profitability and financial success. The specialized accounting processes required for today’s complex building and infrastructure projects would not be possible without advanced software to support the vast array of monitoring, analysis, and reporting tasks.

RIB BuildSmart, our robust construction cost management software, provides a single source of truth for project cost management and accounting that eliminates silos and supports informed financial decision-making. Valuable features like subcontractor management, cash flow forecasting, and real-time cost reporting put essential financial data at your fingertips.

Get your free demo today, and discover how RIB BuildSmart can transform your business!

Most Recent

11 mins read

4 mins read

23 mins read

8 mins read

Blog Categories

Ebook